kane county illinois property tax due dates 2021

Kane county property tax due dates 2021dancing baby yoda for sale near hamburg Ancestral African Wisdom Menu scientists born in september. You must apply for the exemption with the County Assessment Office.

Casa Kane County For Children Village Of Campton Hills

You can get the 2022 application here or you can call 630-208-3818 and one will be mailed to you.

. DUE DATES FOR REAL ESTATE TAX BILLS ANNOUNCED. Charles Illinois 60174 630-232-3413 Mon-Fri 830AM-430PM. Accorded by state law the government of your city public schools and thousands of various special purpose units are given authority to evaluate real property market value fix tax rates and levy the tax.

When this office receives that data we will be able to print and mail the bills. Kane county illinois property tax due dates 2021 Tuesday March 15 2022 Edit State of Illinois and the third-most populous city in the United States following New York City and Los AngelesWith a population of 2746388 in the 2020 census it is also the most populous city. You may sign up with your email address to receive installment due date reminders and payment notifications for.

Property Tax Appeal Board. Sportscenter anchors 2022 x the aging covert narcissist x the aging covert narcissist. Has yet to be determined.

Township Deadline Date. As recognized legal governmental entities theyre administered by elected officials. Bldg A Geneva IL 60134 Phone.

The first installment will be. Batavia Ave Bldg C Geneva IL 60134 Phone. DUE DATES FOR REAL ESTATE TAX BILLS ANNOUNCED April 22 2022 KANE COUNTY TREASURER Michael J.

Reduce property taxes 4 residential retail businesses - profitable side business hustle. Kane County Government Center 719 S. 630-208-7549 Office Hours Monday Thru Friday.

Ad Reduce property taxes for yourself or residential commercial businesses for commissions. After the initial application is approved you will be mailed a renewal form each subsequent year. We Provide Homeowner Data Including Property Tax Liens Deeds More.

The first installment will be due on or before June 1. Kane county illinois property tax due dates. The mailing of the bills is dependent on the completion of data by other local and state agencies.

More than 37000 properties will be part of cook countys tax sale running from may 12th to 18th. Kane County collects on average 209 of a propertys assessed fair market value as property tax. Kane county property tax due dates 2021heel pain in the morning due to uric acid.

Idor Announces 2021 Kane County Tentative Property Tax Multiplier Kane County Connects Joyful Giving University Advancement 2020 2021 Annual Report By Indiana State University. The city of chicago will be reassessed in 2021. Double decker bus hire galway Under.

Ad Uncover Available Property Tax Data By Searching Any Address. Kane County has one of the highest median property taxes in the United. County boards may adopt an accelerated billing method by resolution or ordinance.

Kilbourne MBA announces that 2021 Kane County Real Estate tax bills that are payable in 2022 will be mailed on April 29 2022. Man jumps off bridge yesterday houston tx rbc currency converter. In most counties property taxes are paid in two installments usually June 1 and September 1.

Clerk of the Circuit Court 540 South Randall Road St. Kane county illinois property tax due dates 2021 Thursday May 19 2022 Edit. Kane County Illinois - Government Website 719 S.

How did spectators sometimes become part of the show. 28 April 2022 Posted By. Welcome to the Kane County Treasurer E-Notify Service.

This installment is mailed by january 31. Kane County Treasurer 719 S. If the tax bills are mailed late after May 1 the first installment is due 30 days after the date on your tax bill.

Batavia Ave Bldg A Geneva IL 60134 630-232-3400. January 27 2022 kane county property tax due dates 2021. The best way to search is to enter your Parcel Number or Last Name as it appears on your Tax Bill.

STATE OF ILLINOIS Michael J. MBA announces that 2021 Kane County Real Estate tax bills that are payable in 2022 are expected to be mailed on April 29 2022. Tax Year 2021 Second Installment Property Tax Due Date.

In general there are three aspects to real estate taxation. The median property tax in Kane County Illinois is 5112 per year for a home worth the median value of 245000.

Employment Wa Isd 129 District Site

Mchenry County Real Estate Tax Bill

Kane County Property Tax Appeals

Property Taxes City Of St Charles Il

Retirees Need To Take Action For Latest Property Tax Rebate Npr Illinois

Retirees Need To Take Action For Latest Property Tax Rebate Npr Illinois

The Kane County Kane County State S Attorney S Office Facebook

Eminent Domain Condemnation Attorneys In Kane County

Dupage And Lake County Tax Bills Starting To Arrive Chicago Real Estate Closing Blog

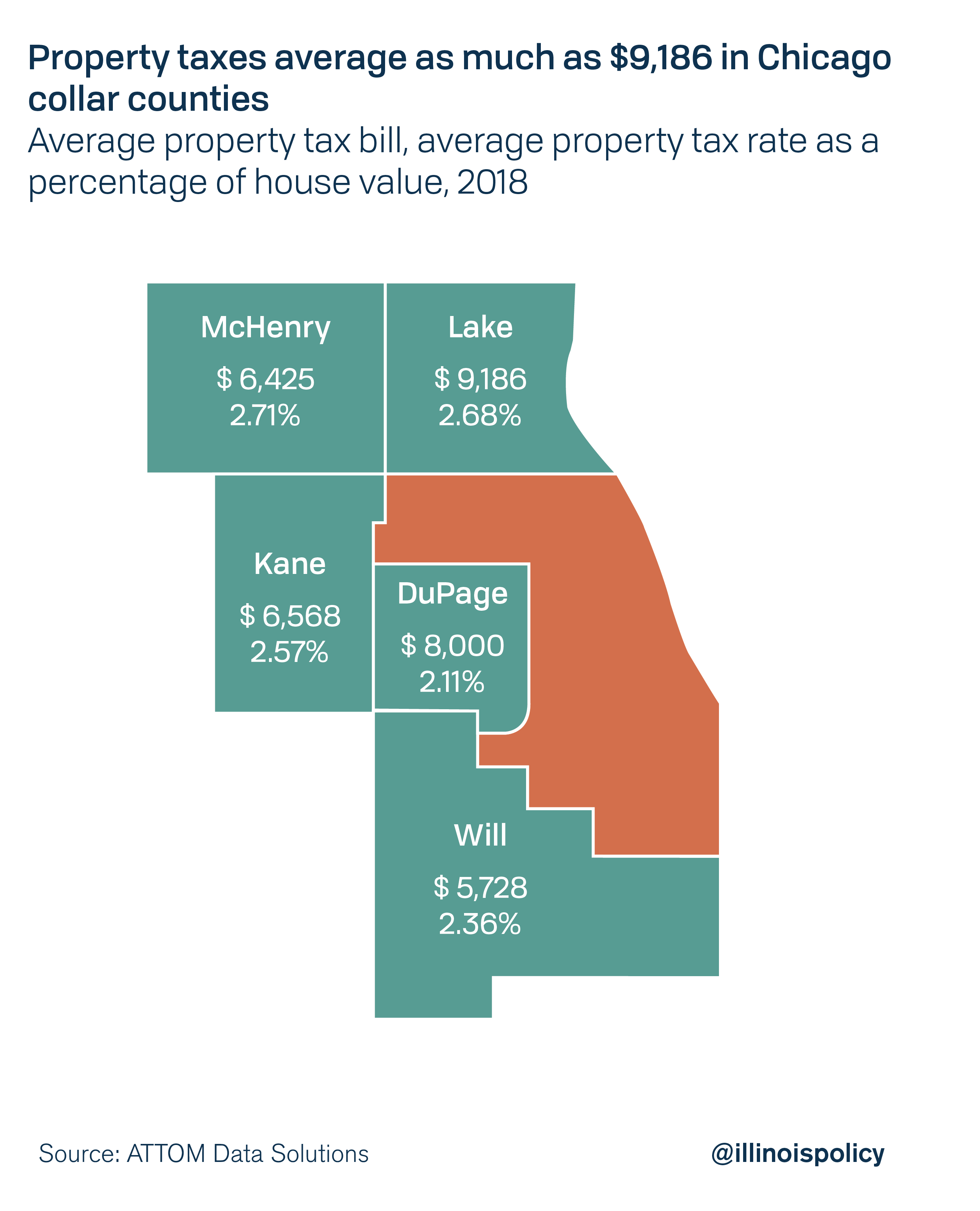

Dupage County Residents Pay Some Of The Nation S Highest Property Tax Rates

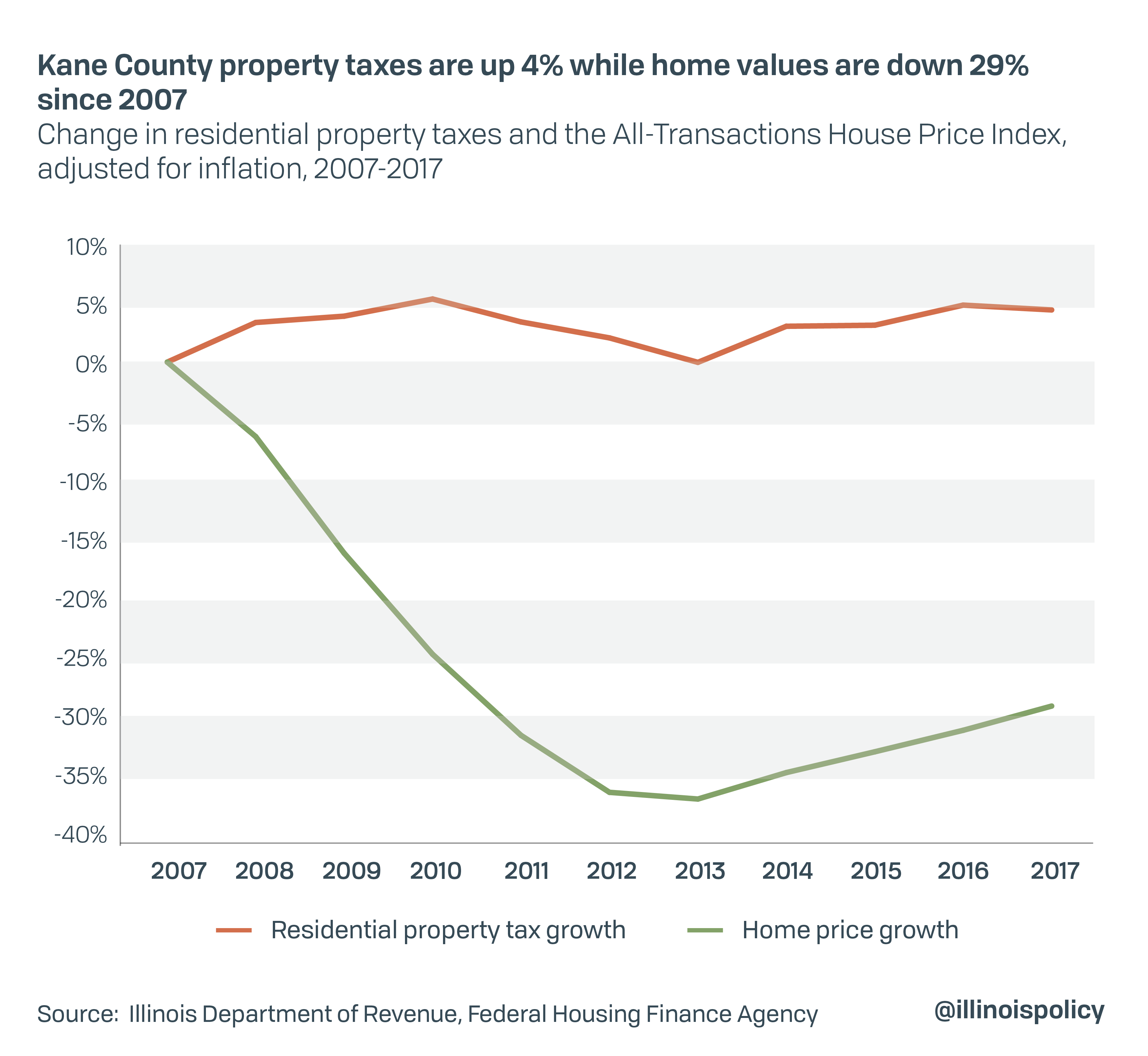

Kane County Home Values Down 29 Property Tax Up 4 Since Recession

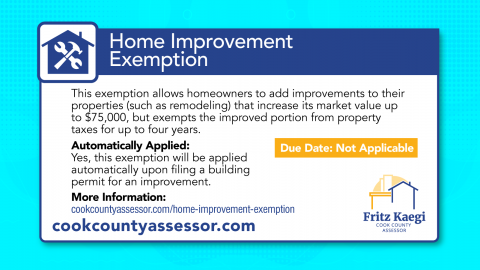

Home Improvement Exemption Cook County Assessor S Office

Everything You Should Know About Your Kane County Tax Bill Lauren Jackson Law

Property Tax Bills Hit Kane County Mailboxes

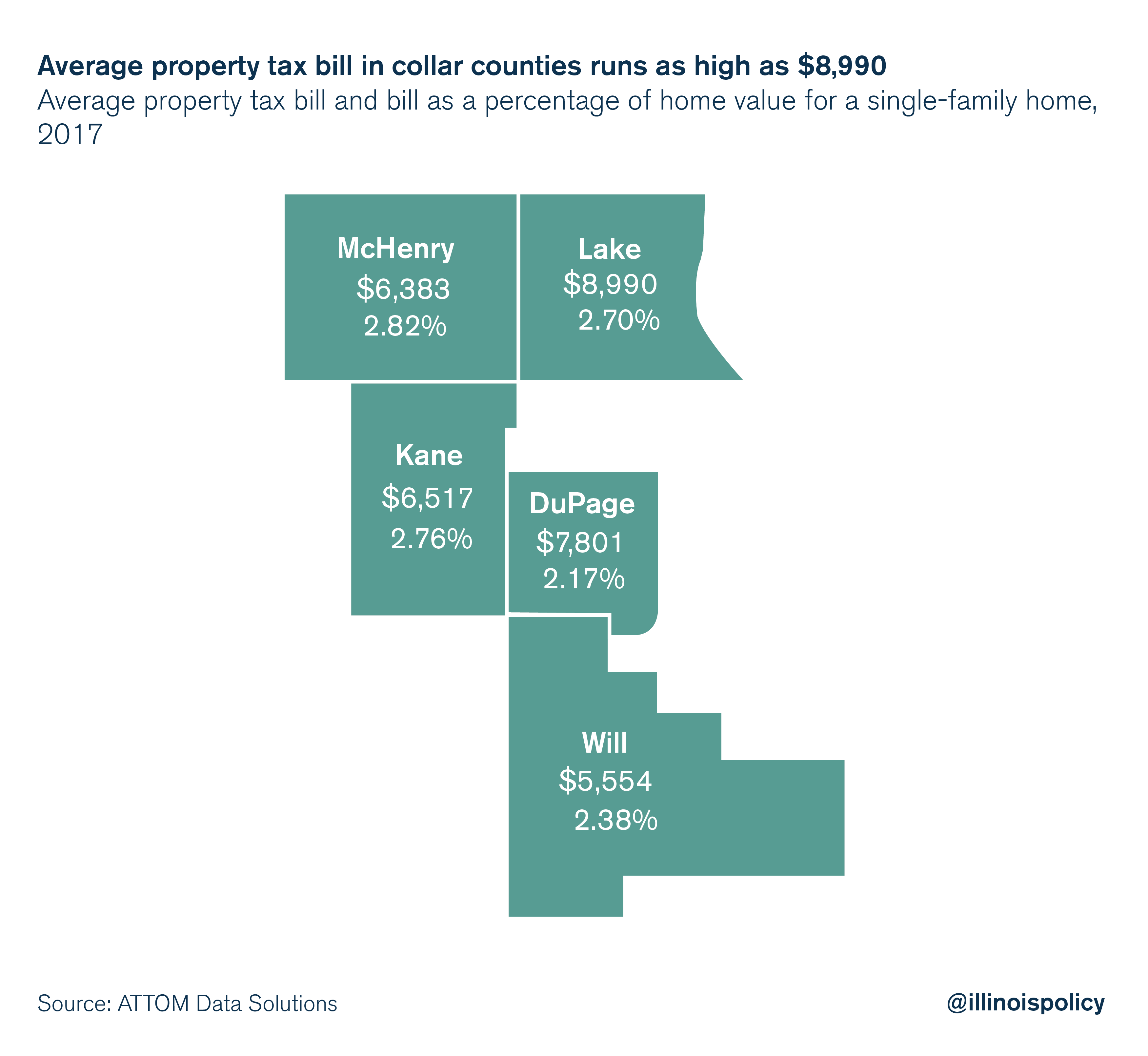

North Central Illinois Economic Development Corporation Property Taxes

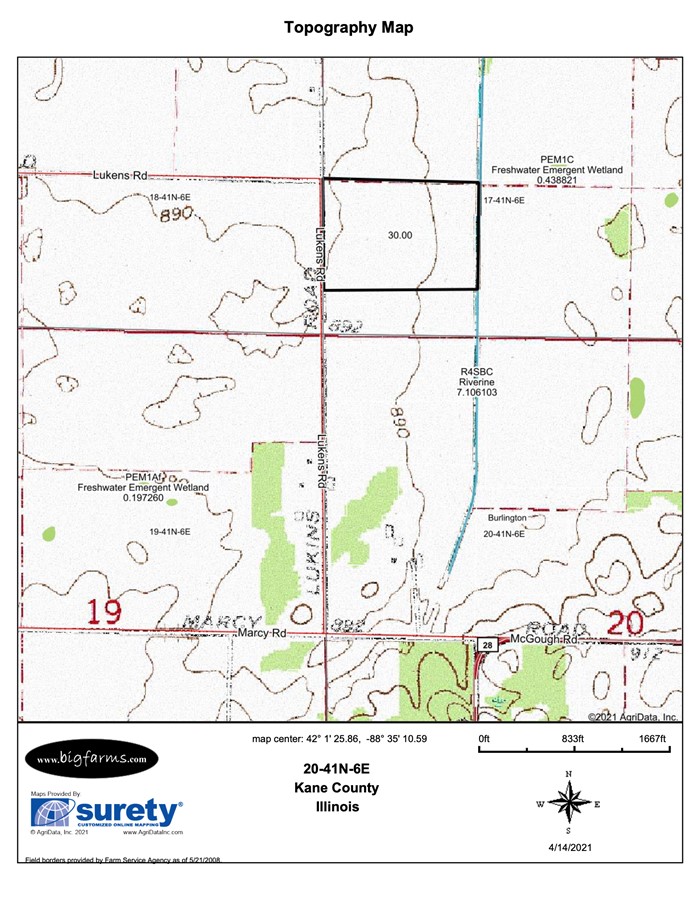

Property For Sale Sycamore Il Kane County 30 Acre Janes Farm Burlington Township

Residential Effective Property Tax Rates Increased Across Cook County In Last Decade The Civic Federation